2021

24 November 2021: PETROLYMPIC ADDED TO THE EVANGELINE LAKE GOLD PROPERTY, BOB TOUGH SHAFT

11 November 2021: Update on the Exploration Status of Rayon d’Or and Vauquelin

27 July 2021: Petrolympic Announces Amendment to Belcourt Acquisition Agreement

11 May 2021: Petrolympic Enters Agreement to Acquire 100% Interest in the Belcourt Gold Property, Near Val d’Or, Quebec

15 March 2021: Petrolympic Enters Agreement to Acquire 100% Interest in the Rayon d’Or Gold Property, Near Val d’Or, Quebec

24 November 2021

PETROLYMPIC ADDED TO THE EVANGELINE LAKE GOLD PROPERTY, BOB TOUGH SHAFT

TORONTO, NOV. 24, 2021 (GLOBE NEWSWIRE) - Petrolympic Ltd. (TSX.V:PCQ) (OTC:PCQRF) (the "Company") is pleased to announce that the Company has entered into an agreement to acquire three (3) additional Mining Claims covering 75 Ha and located in the heart of the previously purchased Evangeline Lake gold property, which consists of 24 map designated mining claims (cells) covering 600 Ha Southwest of Espanola, Ontario, District of Sudbury (NTS 41/04F), approximately 70 km Southwest of the town of Sudbury, a major gold mining center in Central Ontario.

On execution of the purchase agreement between the vendors and the company, the purchase price will be satisfied through the issuance of an aggregate of 200,000 common shares of the Company. Upon the completion of the transaction the Company will have acquired 100% interest in the mineral rights of the Property. The vendors will also receive a 2.0% NSR royalty from all eventual commercial mineral production on the project.

The issuance of the common shares under the transaction shall be subject to applicable securities laws, any securities regulatory authority having jurisdiction, and the policies of the TSX Venture Exchange, and the common shares shall be subject to a four-month hold period in accordance with applicable securities laws and the policies of the TSX Venture Exchange. Completion of the acquisition remains subject to approval by the TSX Venture Exchange.

The gold potential of the property, as outlined in a previous press release dated November 11, 2020 (filed on www.sedar.com), includes the following key elements:

The Evangeline Lake property lies within a belt of Huronian metasediments which strikes east-west for a distance of 53 kilometers. Numerous gold occurrences are found within this belt adjacent to the Charlton Lake Fault in association with diabase dykes and several old gold and silver producing mines were active during the late 1930's and early 1940's within this metasedimentary belt. These mines include the McMillan Gold Mine, Majestic Mine, Bousquet Mine, Hawry Creek Mine and Upsala Mine.

The mineralogical and structural nature of the gold mineralization in Evangeline Lake property is similar to the before-mentioned gold properties. The gold bearing quartz-carbonate veins in the area are apparently associated within and at the contacts of folded quartzite and pelite units in close proximity to diabase sills and dikes. Gold occurs in its native state and intimately associated with arsenopyrite, pyrite, pyrrhotite and chalcopyrite. The gold bearing vein systems are associated with fault/shear zone environments and at pelite/quartzite contacts.

Bob Tough Gold Mines Limited carried out surface exploration and diamond drilling on the property. Based on these results, a three-compartment shaft was sunk to the 150-feet level, where 118 feet of cross cutting was completed. Gold values up to 6.6 g/t Au over 1.36 m were recorded for holes drilled by the company during the late 1930's.

In 1988 a geophysical survey was done on the property. The contoured Magnetometer/VLF-KM surveys outlined numerous east-west trending conductors and magnetic anomalies.

Based on these promising evidence, a thorough exploration program including geological and geophysical surveys will be prepared to generate targets for more detailed exploration works.

Qualified Person

The technical contents of this press release were approved by George Yordanov, professional geologist, an Independent Qualified Person as defined by National Instrument 43-101.

For further information please contact:

Mendel Ekstein

President

82 Richmond St East

Toronto, ON M5C 1P1

Tel. 845-656-0184 Fax 845-231-6665

This news release contains information about adjacent properties on which the Company has no right to explore or mine. Readers are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on the Company's properties.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATIONS SERVICES PROVIDER HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in this press release, including any information regarding the proposed acquisition, constitutes "forward-looking statements." All statements, other than statements of historical fact, are to be considered forward-looking statements. Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, economic, geological and competitive uncertainties and contingencies. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include but are not limited to: economic and global market impacts of the COVID-19 pandemic, fluctuations in market prices, exploration and exploitation successes, continued availability of capital and financing, changes in national and local government legislation, taxation, controls, regulations, expropriation or nationalization of property and general political, economic, market or business conditions. Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance and, therefore, readers are advised to rely on their own evaluation of such uncertainties. All of the forward-looking statements made in this press release, or incorporated by reference, are qualified by these cautionary statements. We do not assume any obligation to update any forward-looking statements.

11 November 2021

Update on the Exploration Status of Rayon d’Or and Vauquelin

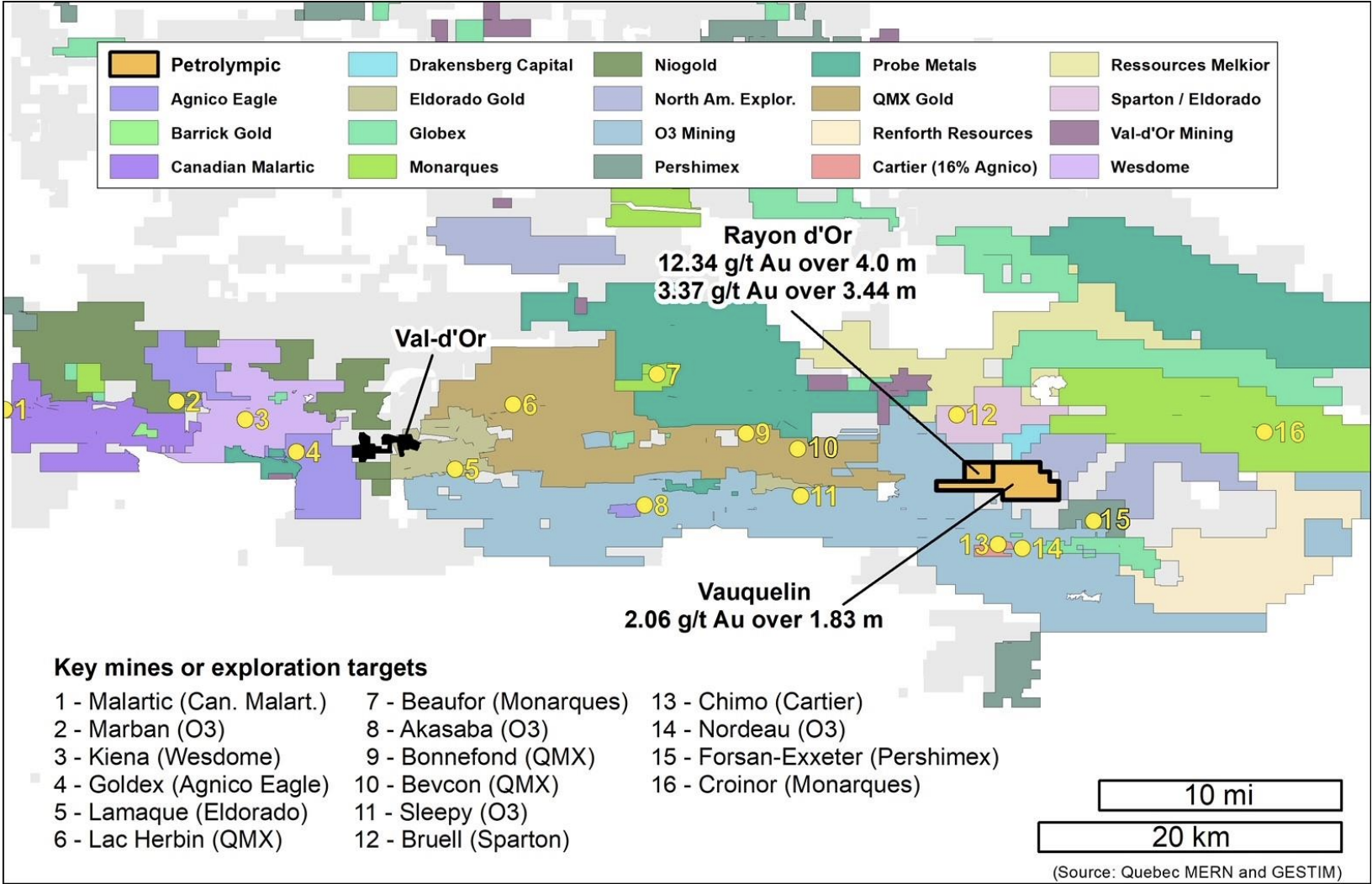

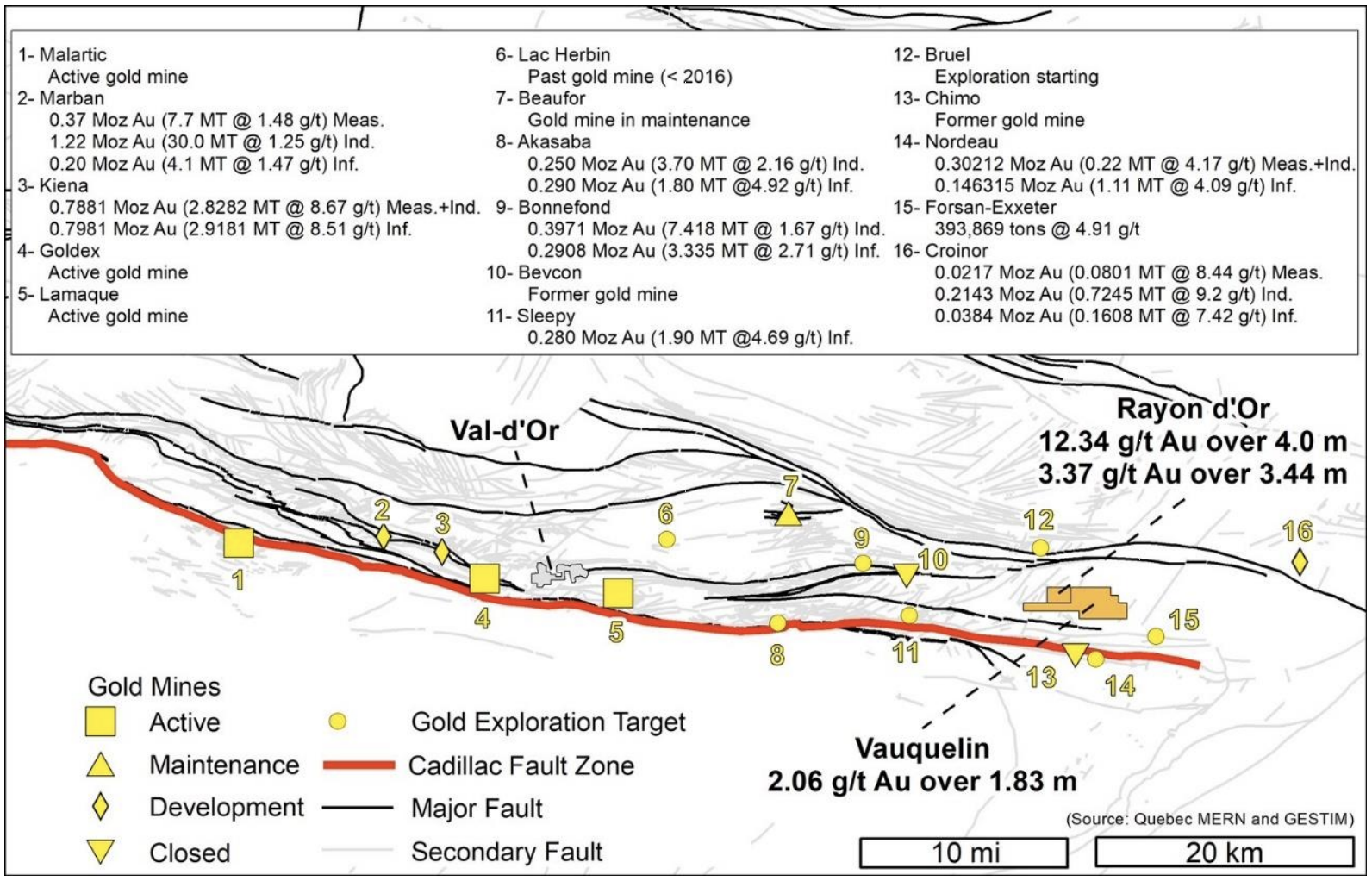

TORONTO, November 11, 2021 – Petrolympic Ltd. (the " Company ", TSXV: PCQ - OTC:PCQRF) is pleased to provide an update on its exploration projects and the potential of the Rayon d’Or and Vauquelin gold properties. Petrolympic is currently developing an exploration program to delineate the extensions of auriferous zones included in the Rayon d’Or and Vauquelin deformation corridor. In particular, the Company is undertaking an airborne magnetic survey followed by a ground Induced Polarization (IP) survey that will help to locate mineralized zones. Detailed mapping of the targeted areas and stripping as needed will follow these surveys, along with a subsequent drilling campaign. On the Rayon d'Or Property specifically, a reinterpretation of the existing data with construction of a 3D model is also planned, to improve the understanding of the mineralized zones of this deformation corridor and develop an effective drilling program, to test the lateral and vertical extensions of known gold-bearing zones. With the recent acquisitions of the Rayon d’Or Property and the adjacent Vauquelin gold property, Petrolympic now owns the rights to an important NW-SE trending structural corridor hosting the Rayon d’Or mineralized zone and its lateral extensions. This zone is part of the regional deformation corridor of the Cadillac Fault, which already includes many active and old mines as well as numerous mineralized zones at different stages of exploration and development. The combined Rayon d’Or and Vauquelin gold properties consist in a total of 37 contiguous map-designated claims (cells) to a grand total of 5,263 Acres of gold potential geology in the center of Vauquelin township (NTS 32C03), approximately 40 km east of the town of Val d’Or, a major gold mining centre in Northwestern Quebec.

Figure 1: Rayon d’Or and Vauquelin Properties

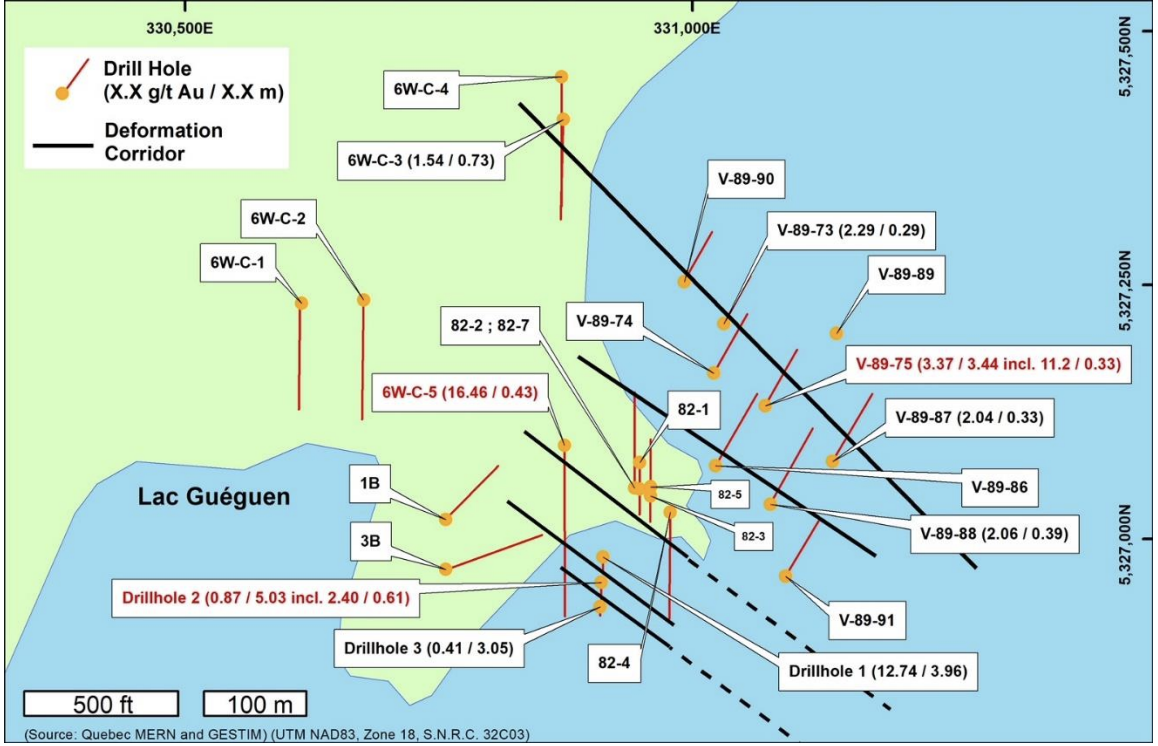

Previous work in the heart of the Rayon d’Or Property has already identified several mineralized structures, in an approximately 300 m wide NW-SE deformation corridor comprising several gold bearing sheared zones intersecting units of rhyolite, andesite and felsic dyke. These structures are injected with quartz-carbonate veins and are mineralized with varying amounts of pyrite, pyrrhotite, chalcopyrite and gold. Most of the previous drilling holes in this property have intersected mineralized zones that have returned gold intersections over variable widths up to 5.0m. The best gold intersections were 12.34 g/t Au over 4.0 m, 3.37 g/t Au over 3.44 m and 16.46 g/t Au over 0.43 m, which were obtained from 3 subparallel mineralized zones and demonstrate the potential for enrichment along deformation corridor (for further details, see the press release dated March 15, 2021, filed on www.sedar.com)

Figure 2: Rayon d’Or Drill Map

The adjacent Vauquelin Property, in comparison, has been the focus of limited work despite a promising potential. Indeed, Vauquelin is a structural continuity of Rayon d’Or and one of the gold-bearing zones of the Rayon d'Or deformation corridor is located within the Vauquelin Property, as revealed by diamond drill hole # 82-6 which returned a gold intersection of 2.06 g/t Au over 1.83m. A series of electromagnetic anomalies scattered throughout the central part of the Property also indicate the possible presence of prospective mineralized zones. Furthermore, approximately 5 km to the south-east of Vauquelin Property, the Forsan-Exxeter gold deposit is also associated with a NW-SE trending mineralized zone which is located in the lateral extension of the same deformation corridor. This gold deposit contains resources in the amount of 393,869 t at 4.91 g/t Au (Louis Perron, 1988, GM-47652).

Figure 3: Regional Exploration Map

Mendel Ekstein, President and CEO of Petrolympic, stated: “We are excited to be undertaking this exploration program on such promising properties in the world-class Val d’Or mining district, one of the best places for gold exploration and production. Our program is expected to produce several drill-ready prospects and advance a number of other prospects closer to drillready stages”. Qualified Person The technical information contained in this news release has been prepared and provided by Alain-Jean Beauregard, P.Geo., a member in good standing of l’Ordre des géologues du Québec (OGQ, member 227) and a Qualified Person within the context of Canadian Securities Administrators' National Instrument ("NI") 43-101; Standards of Disclosure for Mineral Projects.

For further information please contact:

Mendel Ekstein - President 82 Richmond St East Toronto, ON M5C 1P1 Tel. 845-656-0184 Fax 845-231-6665

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATIONS SERVICES PROVIDER HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION Certain information contained or incorporated by reference in this press release, including any information regarding the proposed acquisition, constitutes “forward-looking statements”. All statements, other than statements of historical fact, are to be considered forward-looking statements. Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, economic, geological and competitive uncertainties and contingencies. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include but are not limited to: economic and global market impacts of the COVID-19 pandemic, fluctuations in market prices, exploration and exploitation successes, continued availability of capital and financing, changes in national and local government legislation, taxation, controls, regulations, expropriation or nationalization of property and general political, economic, market or business conditions. Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance and, therefore, readers are advised to rely on their own evaluation of such uncertainties. All of the forward-looking statements made in this press release, or incorporated by reference, are qualified by these cautionary statements. We do not assume any obligation to update any forward-looking statements.

27 July 2021

Petrolympic Announces Amendment to Belcourt Acquisition Agreement

TORONTO, July 27, 2021 (GLOBE NEWSWIRE) -- Petrolympic Ltd. (TSX.V:PCQ) (OTC:PCQRF) (the “Company” or “Purchaser”) announces that the Company has amended the terms of the purchase agreement (“Amended Agreement”) to acquire the Belcourt gold property previously announced May 11th, 2021.

As part of the original agreement the Vendor was to receive 350,000 common share purchase warrants (“Warrants”) conditional on the completion of a future financing and subject to the terms of such financing. The Amended Agreement removes this provision and states that the Company shall issue 350,000 Warrants to the Vendor, upon the approval of the Board of the Purchaser, the TSX Venture Exchange, and any other required regulatory approval of the Amended Agreement. Each such Warrant shall be exercisable to purchase one common share of the Purchaser at a price of $0.12 per common share for a period of 24 months following the date of full approval of the Amended Agreement.

For further information please contact:

Mendel Ekstein - President 8

2 Richmond St East Toronto, ON M5C 1P1

Tel. 845-656-0184

Fax 845-231-6665

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATIONS SERVICES PROVIDER HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION Certain information contained or incorporated by reference in this press release, including any information regarding the proposed acquisition, constitutes “forward-looking statements”. All statements, other than statements of historical fact, are to be considered forward-looking statements. Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, economic, geological and competitive uncertainties and contingencies. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance. Known and unknown factors could cause actual results to differ materially from those projected in the forwardlooking statements. Such factors include but are not limited to: economic and global market impacts of the COVID-19 pandemic, fluctuations in market prices, exploration and exploitation successes, continued availability of capital and financing, changes in national and local government legislation, taxation, controls, regulations, expropriation or nationalization of property and general political, economic, market or business conditions. Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance and, therefore, readers are advised to rely on their own evaluation of such uncertainties. All of the forward-looking statements made in this press release, or incorporated by reference, are qualified by these cautionary statements. We do not assume any obligation to update any forward-looking statements.

11 May 2021

Petrolympic Enters Agreement to Acquire 100% Interest in the Belcourt Gold Property, Near Val d’Or, Quebec

TORONTO, May 11, 2021 (GLOBE NEWSWIRE) — Petrolympic Ltd. (TSX.V:PCQ) (OTC:PCQRF) (the “Company”) is pleased to announce that the Company has entered into an agreement to acquire a gold property located 40 km north of the town of Val-d’Or, a major gold mining centre in Northwestern Quebec (the “Property”). The Property consists of 125 map-designated claims in 4 blocks (Belcourt North, South, Central and West blocks), all proximal to one another and covering a total of 5,479 hectares (54.79 km2, 13,539 acres) in the Barraute, Carpentier, Courville and Fiedmont townships in the Abitibi region. The Property is accessible year-round via Route 397 and a network of secondary roads and trails.

The purchase price will be satisfied through the payment of $15,000.00, the issuance of an aggregate of 1,050,000 common shares of the Company over 2 years, and issuance of warrants to purchase 350,000 common shares of the Company at a price to be determined. The Vendor will also receive a 2.0% NSR (net smelter returns) royalty from all future commercial mineral production on the Property, of which 1.0% can be bought back for $1m at any time.

The issuance of the common shares and the warrants under the transaction shall be subject to applicable securities laws, any securities regulatory authority having jurisdiction, and the policies of the TSX Venture Exchange. Completion of the acquisition remains subject to approval by the TSX Venture Exchange.

The Property is located in the midst of several other large mineral properties such as Monarch Mining, Eldorado Gold, Pershimex Resources, etc. It lies within the Amos-Barraute Volcanic Rock Belt, in the South-central part of the Abitibi Greenstone Belt. Several porphyritic sills are of economic importance in the region, such as the Pershing Manitou, Rolartic and Bigtown porphyries and sills that host appreciable amounts of gold. Several faults and shear zones have also been reported and interpreted in that general area.

Several promising leads have already been identified within the limits of the Property. In the Belcourt South block for example, reconnaissance-scale drilling by Placer Dome in 1989 has identified gold mineralisation in the form of sulphide-bearing quartz-carbonate veins with intervals including 9.12 g/t Au over 0.20 metres (DDH 295-3), 11.42 g/t over 0.37 metres (DDH 295-5), 6.96 g/t Au over 2.17 metres (DDH 295-4), and 30.00 g/t Au over 0.44 metres (DDH 295-7). These, along with other gold-bearing drill hole intercepts, indicate the existence of a gold-bearing system with a good discovery potential. Several Induced Polarization (“IP”), electromagnetic and magnetic anomalies that have also been identified and later confirmed with a soil geochemical survey remain to be tested.

Furthermore, the Property is located within a very favourable metallogenic environment hosting several gold-mineralised structures, mineralised occurrences and mines within a few kilometres of the Property limits and include the following:

Abcourt-Barvue mine with measured and indicated reserves of 8,085,998 tonnes grading 55.38 g/t Ag and 3.06% Zn (2014).

North American Lithium mine with 20.5 million tonnes grading 0,93% Li2O, with an additional 39.3 million tonnes grading 1.04% Li2O classified as indicated reserves (2010) and 18.4 million tonnes grading 1.06% Li2O classified as inferred resources (2017).

McKenzie Break deposit with a non-NI 43-101-compliant 0.42 million tonnes grading 6.27 g/t Au and 0.32 million tonnes at 5.7 g/t Au classified as inferred resources (2018).

Bartec (Ontex) deposit with reserves of 113,400 tonnes grading 7.9 g/t Au (MERNQ SIGEOM, 1987).

Belfort-Roymont deposit with indicated reserves of 66,625 tonnes grading 19.22 g/t Ag, 5.71% Zn, 0.18% Cu and 1.05 g/t Au (2013).

Vendôme No 1 (Mogador) deposit with reserves of 559,506 tonnes grading 1.18 g/t Au, 62.18 g/t Ag, 0.52% Cu and 8.11% Zn and 116,048 tonnes grading 4.55% Zn, 0.49% Cu, 0.73 g/t Au, 40.78 g/t Ag classified as inferred resources (2013).

Tri-Cor showing (103.6 g/t Au over 1.83 metres in a drill hole);

Val d’Or Mining Corporation and Golden Valley Mines (which channel samples grading up to 10.95 g/t Au over 5.5 metres).

Figure 1: Map of Belcourt Properties is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e0946c08-9650-42dd-acd9-7e00df1c5a49

The Company is currently preparing an exploration programme to develop this newly acquired property, that will capitalize on the most recent and more efficient geophysical methods to better outline the targets already identified and to generate new prospects, in the stimulating context of an active and competitive neighbourhood.

All those expressed ore reserves, which could be interpreted as resources in several places, are not necessarily believed to be NI 43-101 compliant.

The content of this release has been reviewed and approved by Pierre LaBrèque, P.Eng., a NI 43-101 qualified professional.

For further information please contact:

Mendel Ekstein – President

82 Richmond St East

Toronto, ON M5C 1P1

Tel. 845-656-0184 Fax 845-231-6665

Cautionary notes related to news release

This news release contains information about adjacent properties on which the Company has no right to explore or mine. Readers are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on the Company’s properties.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATIONS SERVICES PROVIDER HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in this press release, including any information regarding the proposed acquisition, constitutes “forward-looking statements”. All statements, other than statements of historical fact, are to be considered forward-looking statements. Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, economic, geological and competitive uncertainties and contingencies. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include but are not limited to: economic and global market impacts of the COVID-19 pandemic, fluctuations in market prices, exploration and exploitation successes, continued availability of capital and financing, changes in national and local government legislation, taxation, controls, regulations, expropriation or nationalization of property and general political, economic, market or business conditions. Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance and, therefore, readers are advised to rely on their own evaluation of such uncertainties. All of the forward-looking statements made in this press release, or incorporated by reference, are qualified by these cautionary statements. We do not assume any obligation to update any forward-looking statements.

15 March 2021

Petrolympic Enters Agreement to Acquire 100% Interest in the Rayon d’Or Gold Property, Near Val d’Or, Quebec

TORONTO, March 15, 2021

Petrolympic Ltd. (TSX.V:PCQ) (OTC:PCQRF) (the "Company") is pleased to announce that the Company has entered into an agreement to acquire a gold property located in the east of the Val d´Or mining camp, Province of Quebec (the "Property"). The Property consists of two contiguous map-designated claims (cells) (no. 45248 & 45251) covering 285.9Acres which are part of a group of six claims (853total Acres) recently purchased, complementing a unifying a total of 37 contiguous map-designated claims (cells) to a grand total of 5263 Acres of gold potential geology in the center of Vauquelin township (NTS 32C03) approximately 40 km east of the town of Val d’Or, a major gold mining centre in Northwestern Quebec.

On execution of the purchase agreement with the vendor, 1039244 BC. Ltd, the Company will pay the vendor an aggregate cash payment of $75,000 as part of the purchase price. The remainder of the purchase price will be satisfied through the issuance of an aggregate of 900,000 common shares of the Company and work commitments over 4 years. Upon the completion of the transaction the Company will have acquired 100% interest in the mineral rights of the Property. The vendor will also receive a 1.5% NSR royalty from all eventual commercial mineral production on the project of which 0.5% can be bought back for $500,000 at start of production.

The issuance of the common shares under the transaction shall be subject to applicable securities laws, any securities regulatory authority having jurisdiction, and the policies of the TSX Venture Exchange, and the common shares shall be subject to a four-month hold period in accordance with applicable securities laws and the policies of the TSX Venture Exchange. Completion of the acquisition remains subject to approval by the TSX Venture Exchange.

The Property is underlain by volcano-sedimentary units of intermediate to mafic composition of the Val-d’Or Formation with associated synvolcanic intrusions. The Vauquelin-Pershing batholithic intrusive complex occupies the eastern part of the property.

Figure 1: Regional Property Map

Previous work has identified several sheared, altered, schistozed and mineralized NNWSSE structure steeply dipping to SW. These structures are hosted within rhyolites, locally porphyritic andesites and several porphyritic felsic dykes. The mineralized structures are injected with quartz-carbonate veins and veinlets which are associated with sulfides. The sulfide mineralization mainly consist of pyrite, pyrrhotite, chalcopyrite and gold. Previous drilling has delineated two auriferous zones with most significant intersections of 3.37 g/t Au over 3.44 m and 12.34 g/t Au over 4.0 m.

Geoscientific compilation of available data (geophysical, geological and geochemical) demonstrates the most likely orientation of the mineralized structures as well as their possible lateral and depth extensions. The presence of gold (Au), silver (Ag), copper (Cu) and zinc (Zn) geochemistry soil 'B' Horizon, several Induced Polarization (IP-Resistivity) anomalous zones and axes, as well as two gold mineralized zones intersected by drilling confirm the favourable potential of the Rayon d’Or Property.

Several gold deposits were found in the area in the past, such as:

- Forsan-Exxeter with 393,869 t @ 4.91 g/t Au (L. Perron, 1988, GM 47652, MERNQ).

- Bevcon-Buffadisson, a past producing gold mine from 1945 to 1967 with 438,000 ounces of gold @ 4.30 g/t Au average grade (Sigeom, MERNQ).

- Croinor Gold Deposit with proven and probable reserves totaling 602,994 t @ 6.66 g/t Au (Monarch Gold Corporation website).

- Cadillac East Group - Nordeau West Deposit with inferred resources of 1,1 Mt @ 4.09 g/t Au (O3 Mining Inc. website).

- Chimo Gold Mine located approximately seven kilometers south with Indicated Resources of 4,017,600 tonnes @ 4.53 g/t Au and Inferred Resources of 4,877,900 tonnes @ 3.82 g/t Au (Cartier Resources Inc. press release dated May 5, 2020).

- Sleepy Lake Gold Deposit of Probe Metals with 1,85 Mt Au @ 4.7 g/t Au for 279,760 ounces of gold. (2014 NI 43-101 Technical Report).

Figure 2: Rayon D’or and Vauquelin Properties

The Rayon d’Or Property is located within a very favourable metallogenic environment hosting several gold mineralized structures, deposits and past producers. Exploration programs will consist of geological, geophysical and geochemical surveys and follow-up drilling on generated priority exploration targets and definition drilling on the extensions of known gold zones permitting the Rayon d’Or Property to improve to an advance project.

Petrolympic continues to pursue and believe in Quebec’s oil and gas potential and intends to proceed with de development of its conventional assets as soon as the regulatory delays are resolved.

An oil reservoir has been documented in the Massé structure (Lower St. Lawrence), with a potential of 53.6 BCF of gas and 52.2 million barrels of oil over a probable average area of 5.2 km2 (an oil equivalent total of 61.1 million barrels of oil equivalent), as estimated by Sproule (see the press release dated May 17, 2016, filed on www.sedar.com). Petrolympic has a 30% working interest in this structure and in the surrounding acreage which also bears a significant potential. Petrolympic has also owns 100% of the adjacent Mitis and Massé properties. In the Mitis Property, several conventional drilling targets have been identified with a potential for dry gas in sandstones (see the press release dated August 31, 2015, filed on www.sedar.com). In the Matapedia Property, a soil gas survey has independently confirmed the occurrence of several prospects identified by seismic data, with a potential for dry gas and condensates in naturally fractured carbonates.

Qualified Person

The technical information contained in this news release has been prepared and provided by Alain-Jean Beauregard, géo., a member in good standing of l’Ordre des Géologues du Québec (OGQ, member 227) and a Qualified Person within the context of Canadian Securities Administrators' National Instrument ("NI") 43-101; Standards of Disclosure for Mineral Projects.

Cautionary notes related to news release

This news release contains information about adjacent properties on which the Company has no right to explore or mine. Readers are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on the Company's properties.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATIONS SERVICES PROVIDER HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in this press release, including any information regarding the proposed acquisition, constitutes "forward-looking statements." All statements, other than statements of historical fact, are to be considered forward-looking statements. Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, economic, geological and competitive uncertainties and contingencies. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include but are not limited to: economic and global market impacts of the COVID-19 pandemic, fluctuations in market prices, exploration and exploitation successes, continued availability of capital and financing, changes in national and local government legislation, taxation, controls, regulations, expropriation or nationalization of property and general political, economic, market or business conditions. Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance and, therefore, readers are advised to rely on their own evaluation of such uncertainties. All of the forward-looking statements made in this press release, or incorporated by reference, are qualified by these cautionary statements. We do not assume any obligation to update any forward-looking statements.

For further information please contact:

The President Mendel Ekstein

82 Richmond St East Toronto, ON M5C 1P1

Tel. 845-656-0184 Fax 845-231-6665